#11 Marginal Cost of Public Funds

Cost to society for every rupee spent by the government

Frameworks

This post comes under the sub-section Frameworks. Under Frameworks we discuss some broad ideas, rules, quick-hacks, and principles that could be applied in a variety of policy related situations. You can use them as cutlery to have a good policy meal!

What is MCPF?

The marginal cost of Public Funds is a public finance concept that is very important for policymakers. It can be defined as the cost to society for every Rs. 1 of government spending. Every rupee that the government spends needs to be raised by taxation. When the government taxes people, it causes disruption in their lives. This disruption has a cost.

In an ideal world, taxation could be done in a frictionless way. Every taxpayer is compliant, every tax collector is non-corrupt, and there is no illegality or criminality. The government could collect taxes in this world without imposing any real cost on society. Hence, in an ideal world, MCPF = 1. This means that the cost to society for every Rs. 1 of government spending is Rs. 1 only.

But things are different in the real world. In the real world, MCPF is always greater than 1. Why?

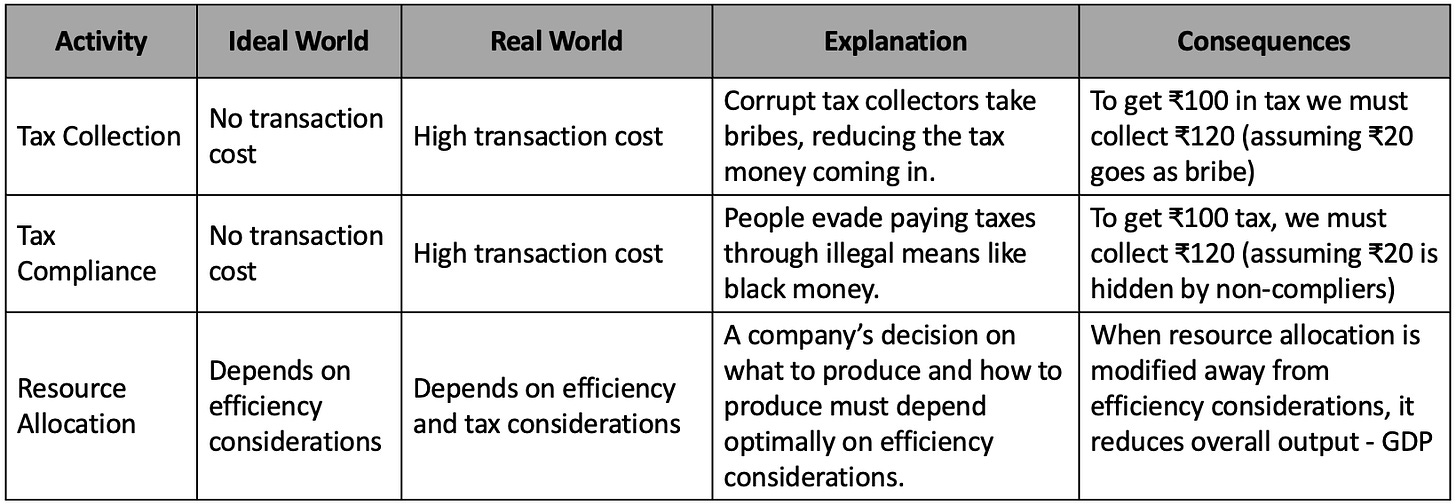

When the government taxes people, there are transaction costs related to compliance, collection, illegality, criminality, administrative costs, etc. On top of this, there is the cost of modified resource allocation. This means that if people are taxed for buying product x, they might choose to buy product y. If income is taxed, people work less. If pineapples are taxed, people consume papayas. This way people modify their choices to adjust for taxes. In other words, resource allocation is modified to adjust to taxes and not efficiency. M. Govind Rao in his book Indian public finance writes about this:

Taxes change the way economic agents behave in a variety of ways. They reduce purchasing power of the people and impact on aggregate demand. They determine the incentives to work, save and invest. No one likes paying taxes.

Check the table below to understand the differences between ideal and real world scenarios and their consequences in the context of MCPF:

India’s MCPF

OECD countries have an MCPF between 1.25 and 2. Indian public finance experts believe that the MCPF in India is around 3. This means that for every Rs. 1 raised by the government, a cost of Rs. 3 is imposed on society.

Having multiple tax rates, not having enough state capacity to monitor tax evasion and/or corruption, bad and useless taxes, etc. are some of the reasons why India has high MCPF. As our country grows in state capacity and solves some of these issues, the MCPF will come down.

Implications

But meanwhile, what is the implication of India's MCPF being 3? It means that whenever the government spends Rs. 1, it needs to know that the cost imposed on society is Rs. 3. So if Rs. 1 of spending doesn't produce benefits that are threefold, then the Rs. 1 spending is better not to be made.

For example, let's say our state government spends Rs. 1000 crore annually to run the state police services. Yes, policing is often done poorly. But without policing, there wouldn't be relative peace, traffic discipline, booking of offences, etc. Hence, there is little doubt that the benefits of policing to society easily exceed Rs. 3000 crore. So we can conclude that government expenses on police services passes the MCPF test.

Like this, each policy of the government, where the government spends a penny, needs to be evaluated for the benefits and costs it brings to the society. MCPF is a useful framework to do this.

Thumb rule: In India, it is useful to reckon that the cost to society for every rupee of public spending is around Rs. 3. So the government should spend Rs. 1 only when they are sure that the gains to society from this expenditure exceed Rs. 3.

I would like to hear from you. Write to me at onepolicyconceptaweek@gmail.com.